Limit Orders

Limit orders on Cabana use a formally verified, open-source CLOB (Central Limit Order Book) called Manifest.

Learn more here (opens in a new tab)

A limit order allows you to define the maximum price you’re willing to pay when buying or the minimum price you’ll accept when selling. Your order will only be executed at your specified price or better, giving you more control over your trades compared to market orders.

How to Place a Limit Order

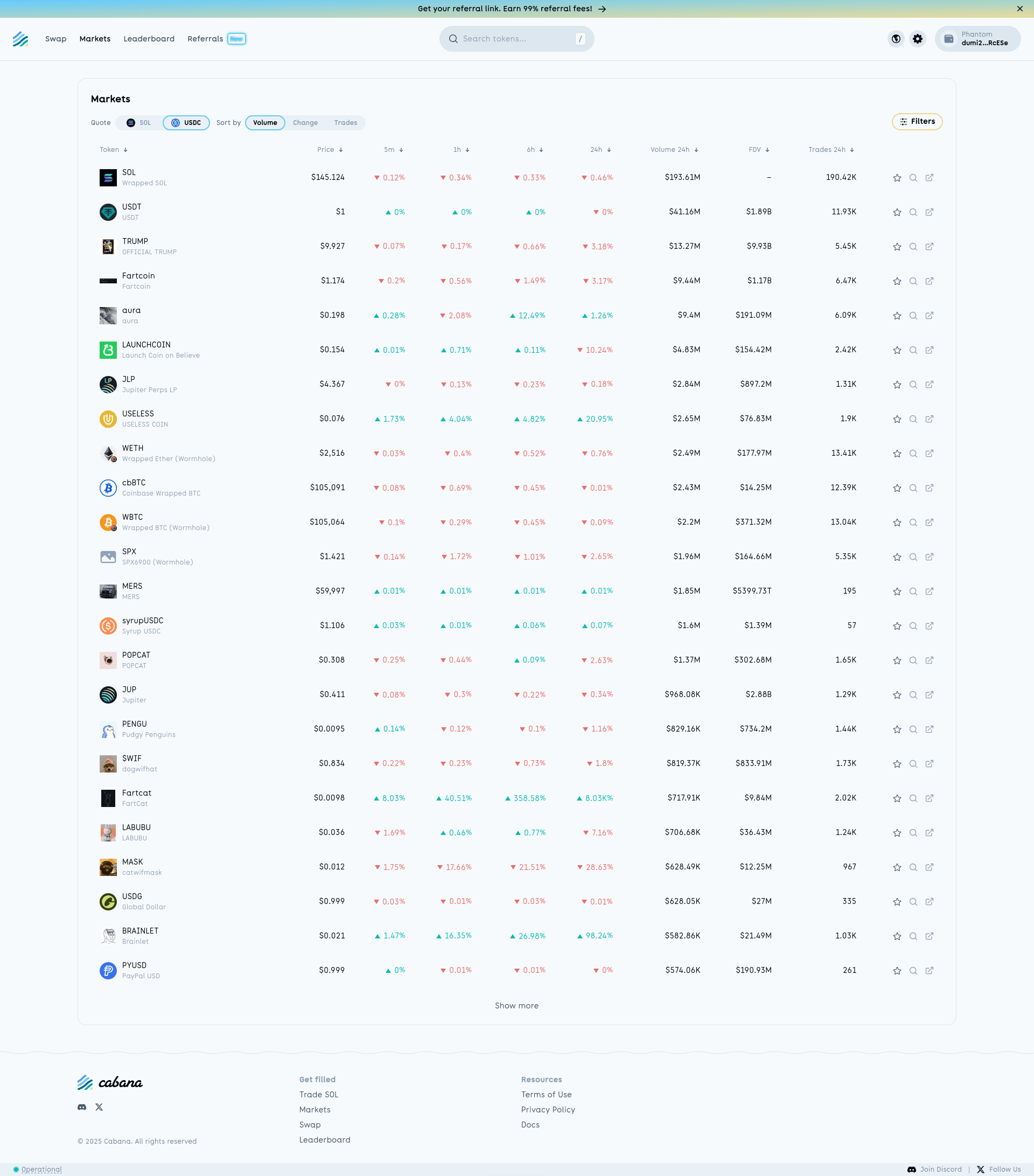

Step 1: Go to the Markets Page

Browse the available tokens on the main markets page.

Step 2: Search for a Token:

Use the search bar if your desired token isn’t immediately visible.

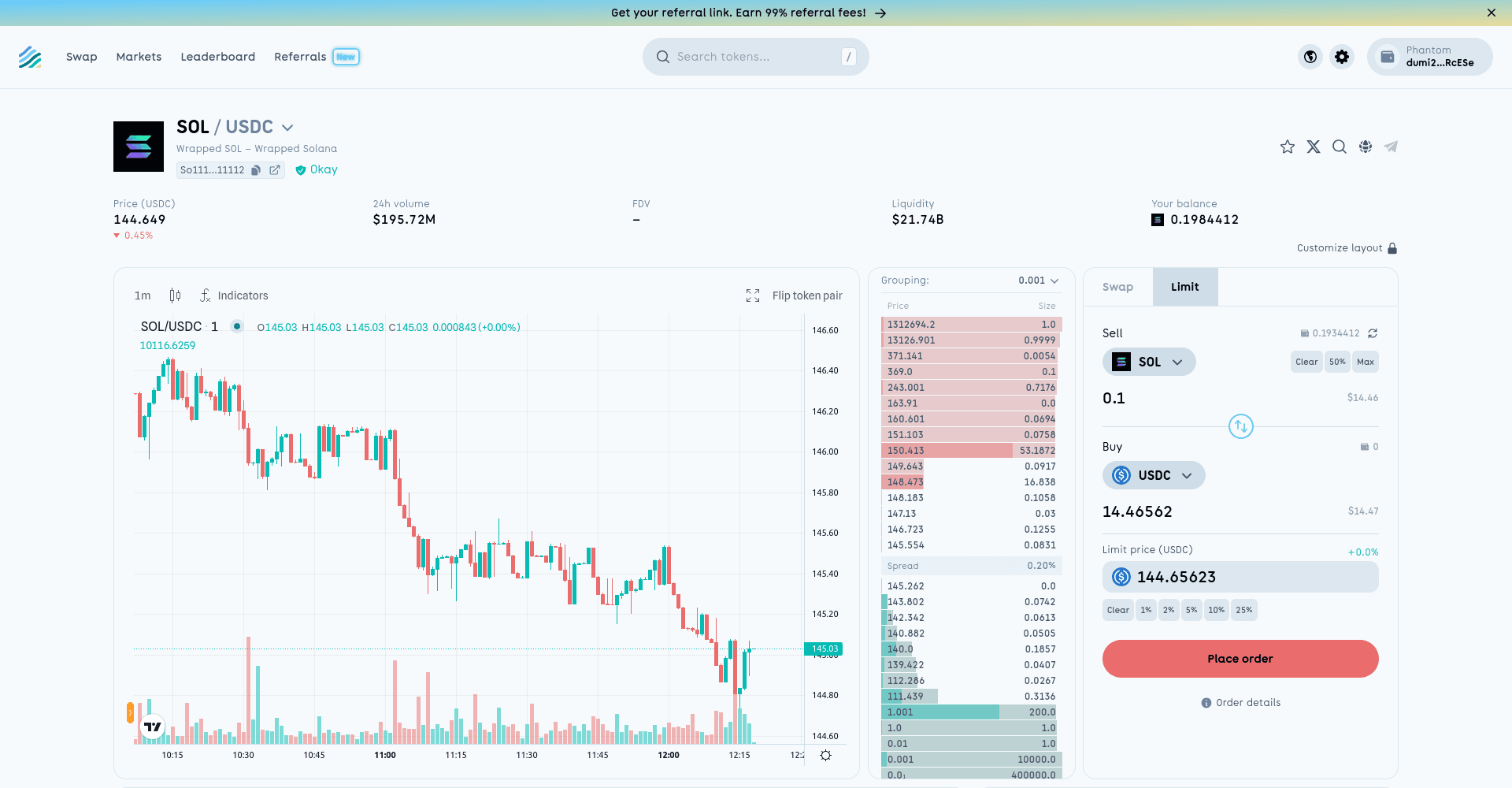

Step 3: Open the Token Page and Select Order Type

Click on the token you want to trade. You’ll see its chart and detailed market information.

Choose Limit from the order type options.

Step 4: Enter Price and Amount:

- Set the price you want to buy or sell at.

- Input the amount of the token.

- Click Place Order to submit.

Your limit order will now appear in Open Orders and will only execute if the market reaches your specified price.

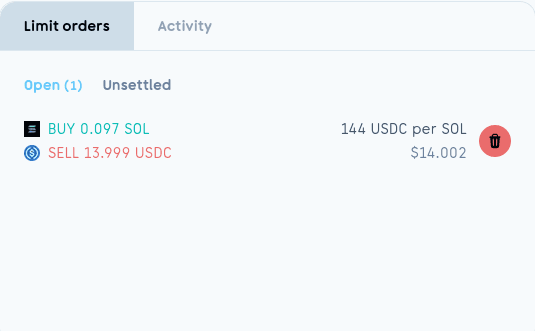

Managing and Settling Orders

You can manage your active limit orders from two places:

- On the Token Page:

Scroll slightly below the place order panel to view the limit order table.

- From the Wallet Side Panel:

Click your wallet address in the top right corner of the DApp to open the wallet panel.

Canceling Orders

To cancel a limit order, click the trash icon in the limit order table.

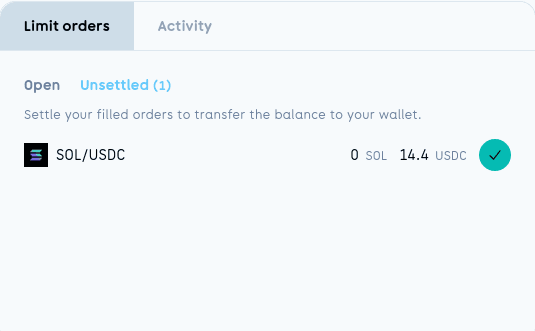

Settling Orders

To settle an executed order, click the green settle button. Once settled, tokens are transferred directly to your wallet.

Advantages of Limit Orders

-

Price Control:

Set the exact price at which you want to buy or sell. -

Cost Efficiency:

Avoid slippage by ensuring your trade only executes at your preferred rate. -

Strategic Trading:

Plan ahead for specific market scenarios, like buying on a dip or selling on a peak.

Disadvantages of Limit Orders

-

Execution Risk:

Your order may not be filled if the market never reaches your limit price. -

Time Sensitivity:

Unlike market orders, limit orders are not immediate and may take longer to execute.

By understanding how limit orders work and when to use them, you can make more strategic and efficient trading decisions on Mangrove.